Which of the following is an example of an internal stakeholder of an organization?

a. A local news station.

b. The distributor for one of the finished products.

c. A newly formed union.

d. The largest stockholder of the company.

e. The suppliers of raw materials for one of the products.

d. The largest stockholder of the company.

The internal stakeholders consist of employees, owners, and the board of directors, if any.

You might also like to view...

A problem encountered when implementing an "infant industry" tariff is that

a. domestic consumers will purchase the foreign good regardless of the tariff. b. special interest groups may prevent the tariff's removal when the industry matures. c. most industries require tariff protection when they are mature. d. labor unions will capture the protective effect in higher wages.

Remove or adjust the features in a photograph to ____________________

a. complement the purpose of your document b. match other photos in your document c. alter it from its original form d. hide any copyright tags

QQAG just announced yesterday that its fourth quarter earnings will be 35% higher than last year's fourth quarter. You observe that QQAG had an abnormal return of 1.7% yesterday. This suggests that

A. the market is not efficient. B. QQAG stock will probably rise in value tomorrow. C. investors expected the earnings increase to be larger than what was actually announced. D. investors expected the earnings increase to be smaller than what was actually announced. E. earnings are expected to decrease next quarter.

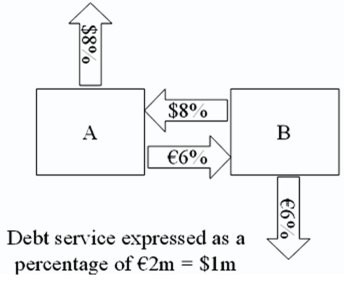

Consider the dollar- and euro-based borrowing opportunities of companies A and B. € borrowing $ borrowingA€7% $8%B€6% $9%A is a U.S.-based MNC with AAA credit; B is an Italian firm with AAA credit. Firm A wants to borrow €1,000,000 for one year and B wants to borrow $2,000,000 for one year. The spot exchange rate is $2.00 = €1.00 and the one-year forward rate is given by IRP as  =

=  .Suppose they agree to the swap shown here. Is this mutually beneficial swap equally fair to both parties?

.Suppose they agree to the swap shown here. Is this mutually beneficial swap equally fair to both parties?

alt="" style="vertical-align: 0.0px;" height="281" width="348" /> A. No, company A saves 1 percent in euro but company B saves only 1 percent in dollars when the spot exchange rate is $2.00 = €1.00-A is twice as better off as B. B. No, company A borrows at 6 percent in euro but company B borrows at 8 percent in dollars. C. Yes, A will be better off by €1 percent on €1m; B by 1 percent on $2m and $2.00 = €1.00. D. Yes, QSD = [€7% ? €6% × $2.00/€1.00] ? ($8% ? $9%) = $2% + $1% = $3%.