In the following situation, the tax system is Taxable income $1,000 $2,000 $4,000 $8,000 Tax payments $10 $30 $90 $270

a. progressive throughout all levels of income

b. progressive between $1,000 and $2,000 of income but regressive above $2,000

c. regressive throughout all levels of income

d. regressive between $1,000 and $2,000 of income but progressive above $2,000

e. proportional throughout all levels of income

A

You might also like to view...

Suppose player 1 potentially moves twice in a sequential game, each time choosing from one of two possible actions -- "Left" or "Right". His first move is at the beginning of the game. He gets to move a second time if he moved "Left" the first time and after observing one of two possible actions by player 2 ("Up" or "Down"). But if he moves "Right" in the first stage, he gets no further moves and the game ends after player 2 chooses one of two actions ("Up" or "Down"). Draw the game tree and list all possible strategies for players 1 and 2.

What will be an ideal response?

The business cycle has two phases,

A) expansion and peak. B) recession and trough. C) peak and trough. D) recession and expansion. E) expansion and trough.

The measurement of economic growth cannot take into account

A) the service sector of an economy. B) productive activity in an economy. C) cultural aspects of life in a country. D) differences in inflation rates across countries.

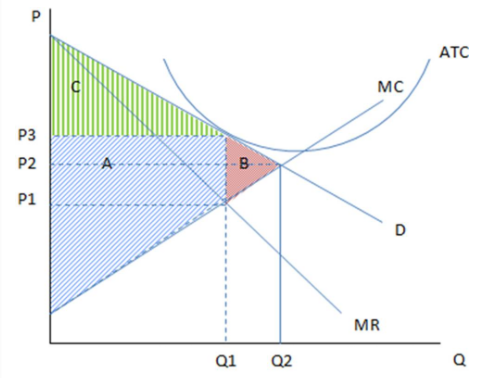

If the firm in the given graph were to produce Q1 and charge P3, the area C would represent:

These are the cost and revenue curves associated with a firm.

A. producer surplus.

B. consumer surplus.

C. deadweight loss.

D. profits.