An internationally discriminating monopolist is one that:

a. can charge different prices to each customer in its domestic market.

b. can charge different prices in its domestic and foreign markets.

c. faces a downward-sloping demand curve in its domestic market and a perfectly elastic demand curve in its foreign market.

d. faces a perfectly elastic demand curve in its domestic market and a downward sloping demand curve in its foreign market.

Ans: b. can charge different prices in its domestic and foreign markets.

You might also like to view...

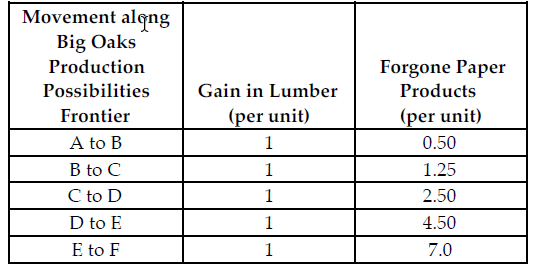

Refer to the table below. If the profit for each unit of paper product is $3.00 and the profit for each unit of lumber is $13.50, what is the marginal benefit for each unit of lumber produced?

Big Oaks can produce either paper products or lumber with each tree that they harvest. Because Big Oaks can adjust the amount of paper products and lumber they produce from the harvested trees, paper products and lumber are produced in variable proportions. The above table summarizes Big Oaks production possibilities from each harvested tree.

A) $13.50

B) $16.50

C) $10.50

D) $3.00

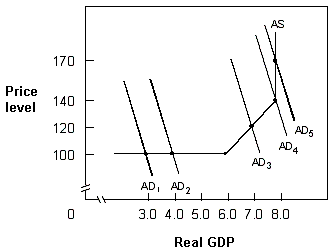

Exhibit 10-8 Aggregate demand and supply

A. real GDP will increase from $3.0 to $4.0, and the price level will increase from 100 to 140. B. real GDP will increase from $3.0 to $7.0, and the price level will increase from 100 to 140. C. real GDP will increase from $3.0 to $4.0, and the price level does not change. D. real GDP will increase from $3.0 to $7.0, and the price level will increase from 100 to 120.

Suppose that a monopoly computer chip maker increases production from 10 microchips to 11 microchips. If the market price declines from $30 per unit to $29 per unit, marginal revenue for the eleventh unit is:

a. $9. b. $19. c. $1. d. $29.

Real GDP was $9,950 Billion in year 1 and $10,270 billion in Year 2. What was the approximate rate of economic growth from year 1 to year 2?

What will be an ideal response?