The term "welfare state" describes the idea that:

A. government has a responsibility to promote the economic well-being of its citizens.

B. some areas suffer from stagnant economic growth.

C. some areas suffer a disproportionate amount of chronic poverty.

D. None of these is true.

Answer: A

You might also like to view...

Starting from long-run equilibrium, a large tax cut will result in a(n) ________ gap in the short-run and ________ inflation and ________ output in the long-run.

A. expansionary; higher; higher B. expansionary; higher; potential C. recessionary; higher; potential D. recessionary; lower; lower

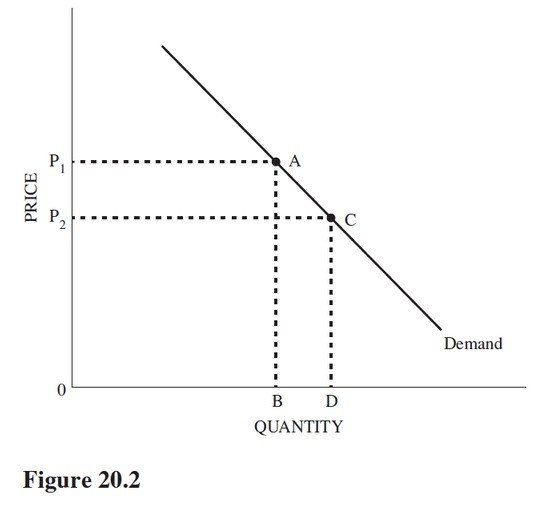

Refer to Figure 20.2. Comparing the price elasticity of demand at points A and C, we can say that

A. Point C has a greater price elasticity of demand in absolute value. B. Demand elasticity is indeterminate because specific price data are not given. C. The elasticities are the same because the points are on the same demand curve. D. Point A has a greater price elasticity of demand in absolute value.

Which of the following institutional structures is most likely to promote growth?

A. A well-enforced system of patents and copyrights. B. A tightly regulated market system. C. A system of tariffs and other trade barriers to protect domestic companies. D. All of these.

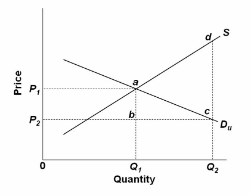

Refer to the demand and supply diagram that relates to the health care market. If suppliers provide whatever quantity of health care is demanded, health care insurance causes:

A. resources to be underallocated to the health care industry.

B. resources to be overallocated to the health care industry.

C. health care to be underconsumed.

D. the price of health care to the insured to be higher than the market price.