A defendant believes there is a 40 percent chance that the plaintiff will win $1,000,000 and a 60 percent chance that the plaintiff will lose and be awarded nothing (zero). The plaintiff believes that there is a 60 percent chance that they will win $1,000,000 and a 40 percent chance that they will be awarded nothing (zero). The plaintiff's litigation cost is $300,000 and the defendant's

litigation cost is $300,000. Which of the following statements is true?

A) The defendant would be willing to pay up to $800,000 to settle.

B) The plaintiff would be will to accept any amount greater than $200,000 to settle.

C) The plaintiff would be will to accept any amount greater than $300,000 to settle.

D) There is no economic incentive for either party to settle.

C) The plaintiff would be will to accept any amount greater than $300,000 to settle.

You might also like to view...

For the majority of the U.S. population ________

A) consumption is driven solely by current income B) consumption smoothing is possible C) a change in lifetime resources will not change current consumption D) a change in lifetime resources will not change future consumption

Subtracting all exemptions, except for _____, gives the taxpayer's adjusted gross income

a. capital gains exemptions b. personal exemptions c. business expenses exemptions d. home office exemptions

Fluctuations in the foreign ________________ rate can affect an economy’s ability to repay its outstanding international debt in the short run.

a. unemployment b. exchange c. production d. return

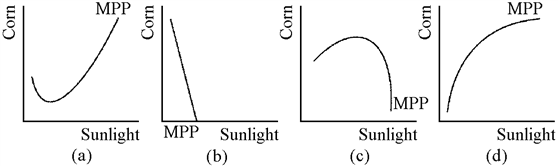

Figure 7-12

Which of the graphs in Figure 7-12 shows a marginal physical product curve that exhibits first increasing, and then diminishing, marginal returns to sunlight?

a.

(a)

b.

(b)

c.

(c)

d.

(d)