What is a credit-default swap?

What will be an ideal response?

A CDS is a credit derivative that allows lenders to insure themselves against the risk that a borrower will default. The buyer of a CDS makes payments to the seller, and the seller agrees to pay the buyer if an underlying loan or security defaults.

You might also like to view...

Refer to Figure 4.8. If half of your friends go to the beach and half go to the park, you will receive a payoff of ________ if you go to the park

A) 0 B) 250 C) 500 D) You cannot determine the payoff from the data in the figure.

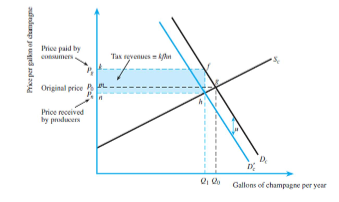

Refer to the figure below. Suppose the original before-tax demand curve for CD players is P = 100 - 2Q d . Suppose further that supply is P = 5 + 3Q s . Now suppose a $5 unit tax is imposed on consumers.

(A) What is the before-tax equilibrium price and quantity?

(B) What is the after-tax equilibrium price and quantity?

(C) How much tax revenue is raised?

Which of the following statements describes the presence of diminishing returns? All else equal,

a. Marginal product is constant as output increases b. Marginal product is falling as output increases c. Marginal product is rising as output increases d. Marginal product is zero

The expansion path of product indifference curves shows the cost-minimizing combination of inputs

a. True b. False Indicate whether the statement is true or false