Answer the following statement(s) true (T) or false (F)

If a company has its headquarters in the United States but has offices in other countries, it only needs to follow US law.

Ans: False

You might also like to view...

Answer the following statements true (T) or false (F)

1. If an asset is disposed of during the year, there is no need to calculate depreciation from the beginning of the year of disposal to the date of disposal. 2. A business, which has a calendar year accounting period, purchased an asset on March 1, 2018. The business disposed of the asset on August 31, 2019. For the calendar year 2019, depreciation should be calculated from January 1 to August 31. 3. If a business changes the estimated useful life, or estimated residual value, of a plant asset, depreciation expense must be recalculated. 4. When a company makes an accounting change in estimate, Generally Accepted Accounting Principles require that the company make changes to financial statements of prior years.

A foreign company has offered to buy 85 units for a reduced sales price of $350 per unit. The marketing manager says the sale will not affect the company's regular sales. The sales manager says that this sale will require variable selling and administrative costs. The production manager reports that it would require an additional $30,000 of fixed manufacturing costs to accommodate the specifications of the buyer. If Belfry accepts the deal, how will this impact operating income? (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar.)

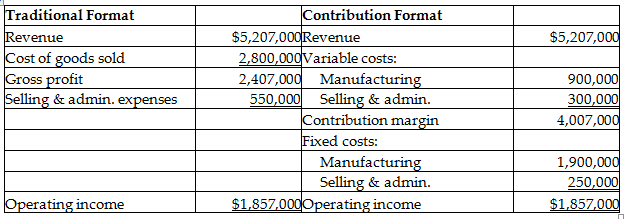

Belfry Company makes special equipment used in cell towers. Each unit sells for $410. Belfry produces and sells 12,700 units per year. They have provided the following income statement data:

A) Operating income will increase by $8282.

B) Operating income will decrease by $8282.

C) Operating income will increase by $29,750.

D) Operating income will decrease by $21,719.

A manager is attempting to determine whether a segment of the business should be eliminated. The focus of attention for this decision should be on

a. the net income shown on the segment's income statement. b. sales minus total expenses of the segment. c. sales minus total direct expenses of the segment. d. sales minus total variable expenses and avoidable fixed expenses of the segment.

Which of the following is recommended when presenting your plan?

a. Give the best-case scenario for your business in order to attract others. b. Be conservative in your financial and market forecasts. c. Be certain that you can capture 30% to 40% of the targeted market. d. Be certain that you can overtake your main competitor within one year.