In the long run,

A) unemployment is at its natural rate. B) GDP > potential GDP.

C) LRAS and SRAS lie on the same line. D) the inflation rate is zero.

A

You might also like to view...

Using the above figure, which of the following is CORRECT?

A) 1 guilder will sell for $2. B) 1 dollar will sell for 1/2 guilder. C) A shortage of guilders exists at an exchange rate above $0.60. D) A surplus of guilders exists at an exchange rate above $0.60.

Mikkelson Corporation's stock had a required return of 11.75% last year, when the risk-free rate was 5.50% and the market risk premium was 4.75%. Then an increase in investor risk aversion caused the market risk premium to rise by 2%. The risk-free rate and the firm's beta remain unchanged. What is the company's new required rate of return? (Hint: First calculate the beta, then find the required return.)

a.14.38% b.14.74% c.15.11% d.15.49%e.15.87%

Mitchell's money income is $150, the price of X is $2, and the price of Y is $2. Given these prices and income, Mitchell buys 50 units of X and 25 units of Y. Call this combination of X and Y bundle J. At bundle J, Mitchell's MRS is 2. At bundle J, if Mitchell increases consumption of Y by 1 unit, how many units of X can he give up and still reach the same level of utility?

A. 4 B. ½ C. 1 D. 2

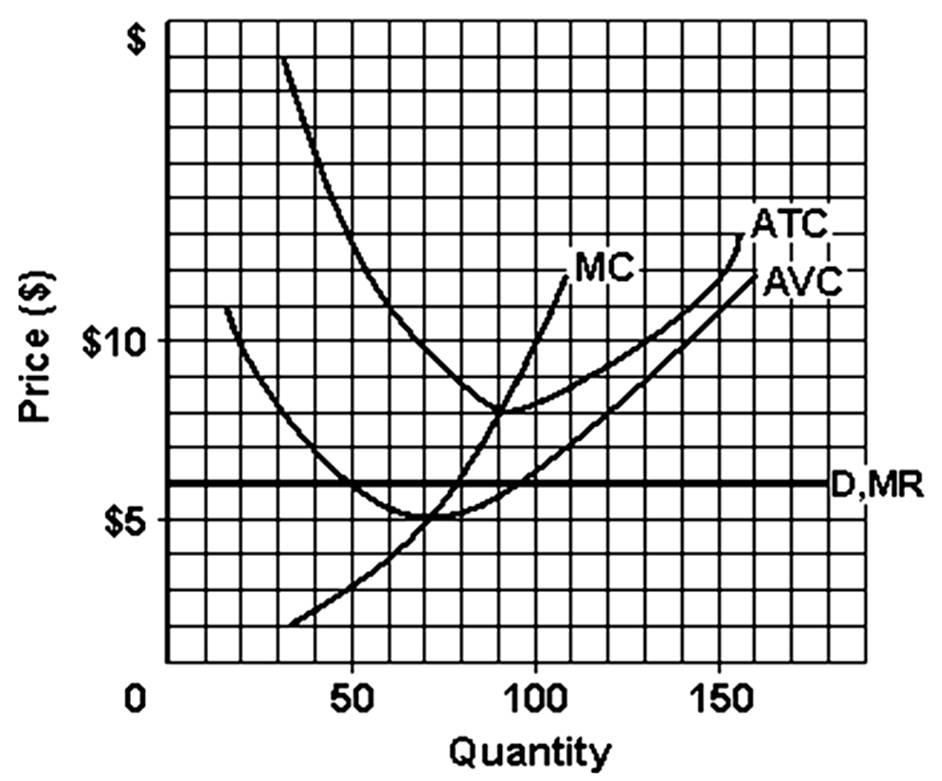

The firm's most efficient output would be

A. 70 units.

B. 80 units.

C. 90 units.

D. 100 units.