Mikkelson Corporation's stock had a required return of 11.75% last year, when the risk-free rate was 5.50% and the market risk premium was 4.75%. Then an increase in investor risk aversion caused the market risk premium to rise by 2%. The risk-free rate and the firm's beta remain unchanged. What is the company's new required rate of return? (Hint: First calculate the beta, then find the required return.)

a.14.38%

b.14.74%

c.15.11%

d.15.49%e.15.87%

Ans: a.14.38%

You might also like to view...

The table above shows the demand and costs for a single-price monopolist. The firm can maximize its profit by selling

A) 0 units. B) 20 units. C) 40 units. D) 60 units.

The federal government began to measure poverty in the

a. 1960s. b. 1970s. c. 1980s. d. 1990s.

If the income multiplier is 4, then 0.5 is equal to the marginal propensity to consume

Indicate whether the statement is true or false

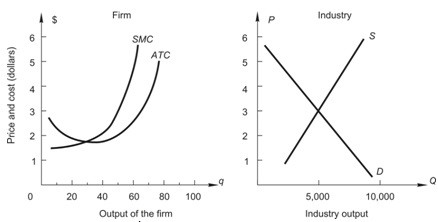

Below, the graph on the left shows the short-run cost curves for a firm in a perfectly competitive market, and the graph on the right shows the current market conditions in this industry. In order to maximize profit, how much output should the firm produce?

A. 60 units B. 80 units C. 20 units D. 40 units E. 50 units