How does the use of an NOL differ for individual and corporate taxpayers?

What will be an ideal response?

An individual must make adjustments to his taxable income to calculate his NOL. A corporation's NOL is simply the excess of its deductions over its income.

You might also like to view...

The shortest possible time to complete an activity is referred to as the activity’s?

a. Window time b. Crash time c. Pessimistic time d. Limit time

Felix Corp. is a cookware manufacturer. It conducts market testing for a new appliance. JK Corp., a competitor of Felix, reduces its prices during the market test to prevent Felix from collecting accurate information. In this scenario, JK Corp. is engaging in a practice called _____.

A. clustering B. positioning C. pretesting D. jamming E. scaling

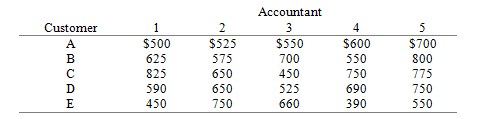

Five customers needing their tax returns prepared must be assigned to five tax accountants. The estimated profits for all possible assignments are shown below. Only one accountant can be assigned to a customer, and all customers' tax returns must be prepared. What should the customer–accountant assignments be so that estimated total profit is maximized? What is the resulting total profit?

What will be an ideal response?

Branin Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $160,000, variable manufacturing overhead of $3.40 per direct labor-hour, and 80,000 direct labor-hours. The company has provided the following data concerning Job A578 which was recently completed: Total direct labor-hours 250Direct materials$715Direct labor cost$9,000The total job cost for Job A578 is closest to: (Round your intermediate calculations to 2 decimal places.)

A. $9,715 B. $2,065 C. $11,065 D. $10,350