Which of the following policies would a Keynesian expect to produce the largest decrease in income?

a. a reduction in government spending of $100 billion

b. a decrease in transfer payments of $100 billion

c. an increase in government spending of $100 billion

d. a tax increase of $100 billion

a

You might also like to view...

The demand and supply functions for sweatshirts (the basic grey kind) are as follows:

Demand Supply Quantity Quantity Demanded Supplied Price (per period) Price (per period) $10 15,000 $10 22,000 9 15,500 9 19,000 8 16,000 8 16,000 7 16,500 7 13,000 6 17,000 6 10,000 5 17,500 5 7,000 4 18,000 4 4,000 3 18,500 3 1,000 2 19,000 2 0 a. Graph the demand and supply functions for sweatshirts and find the equilibrium price and quantity. b. What effect will an increase in the price of gym shoes (a complement) have on the equilibrium price and quantity of sweatshirts, all else constant? Illustrate the effect using your graph. c. What effect will a wage increase for workers in the sweatshirt industry have on the equilibrium price and quantity of sweatshirts, all else constant? Illustrate the effect using your graph.

Tomato sauce and spaghetti noodles are complementary goods. A decrease in the price of tomatoes will

a. increase consumer surplus in the market for tomato sauce and decrease producer surplus in the market for spaghetti noodles. b. increase consumer surplus in the market for tomato sauce and increase producer surplus in the market for spaghetti noodles. c. decrease consumer surplus in the market for tomato sauce and increase producer surplus in the market for spaghetti noodles. d. decrease consumer surplus in the market for tomato sauce and decrease producer surplus in the market for spaghetti noodles.

If markets are perfectly competitive and production of a good results in water pollution, the imposition of a tax on the good will:

A. reduce the number of firms producing that good in the long run. B. reduce the number of firms producing that good in the short run. C. increase the number of firms producing that good in the long run. D. increase the number of firms producing that good in the short run.

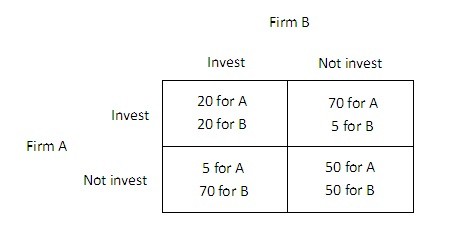

The payoff matrix below shows the payoffs (in millions of dollars) for two firms, A and B, for two different strategies, investing in new capital or not investing in new capital.  An industry spy comes to firm B and claims to know what firm A has decided. Given that each firm already knows the payoff matrix, how much would this information be worth to firm B?

An industry spy comes to firm B and claims to know what firm A has decided. Given that each firm already knows the payoff matrix, how much would this information be worth to firm B?

A. $30 million. B. $0. C. $70 million. D. $50 million.