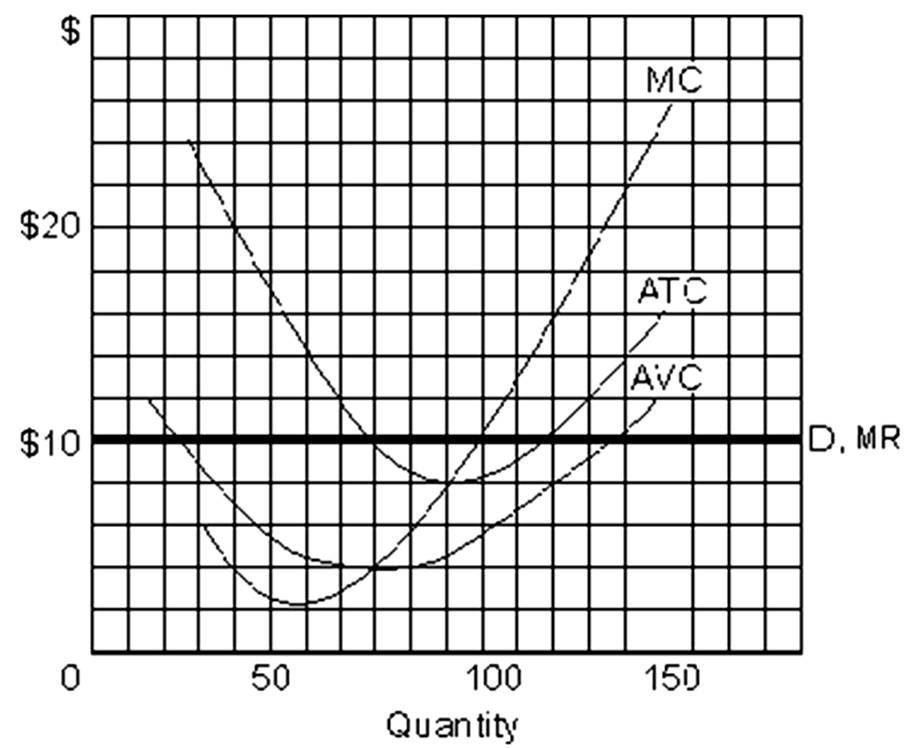

The firm's most efficient output would be

A. 50.

B. 80.

C. 90.

D. 100.

C. 90.

You might also like to view...

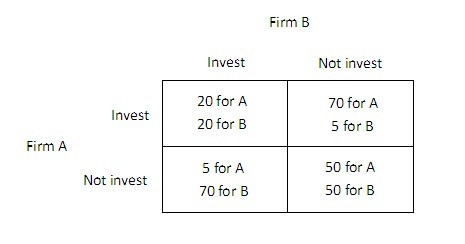

The payoff matrix below shows the payoffs (in millions of dollars) for two firms, A and B, for two different strategies, investing in new capital or not investing in new capital.  An industry spy from firm A comes to firm B and offers to pay B in exchange for B's certain and enforceable promise to not invest. What is the most that firm A will be willing to pay B to not invest?

An industry spy from firm A comes to firm B and offers to pay B in exchange for B's certain and enforceable promise to not invest. What is the most that firm A will be willing to pay B to not invest?

A. $30 million. B. $50 million. C. $20 million. D. $35 million.

If the market interest rate is 5% and a bank advertises loans at 12%, the bank will receive

A) no applications. B) applications from mostly low-risk borrowers. C) applications from mostly high-risk borrowers. D) a moral hazard.

If an increase in the growth rate of AD leads to an increase in real GDP in the short run: a. the increase in AD was correctly anticipated

b. the increase in AD was greater than anticipated. c. the increase in AD was less than anticipated. d. the increase in AD could have been any of the above.

Current income is 300, expected future income is 363, and the interest rate is 10%. If income rises by $63 in each period, so Y(1) = 363 and Y(2) = 426, then in each period consumption

a) also rises by $63 b) becomes 390 c) rises by $56.7, or 90% of $63 d) remains constant e) rises by $126