Suppose that a decision maker's risk attitude toward monetary gains or losses x given by the utility function U(x) =

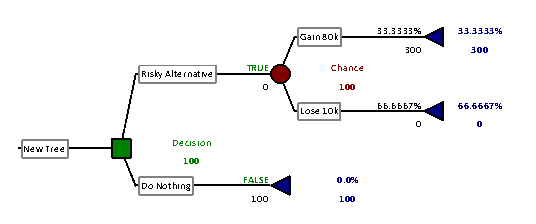

Show that this decision maker is indifferent between gaining nothing and entering a risky situation with a gain of $80,000 (probability 1/3) and a loss of $10,000 (probability 2/3).

What will be an ideal response?

The tree above shows the utility values using this utility function. Since the expected utilities for the two alternatives are equal, the decision maker is indifferent between them (PrecisionTree defaults to the upper branch in such situations)

You might also like to view...

There was "no sense of industry" for the Marketing Research industry in the 1950s

Indicate whether the statement is true or false

The "market" version of utilitarianism argues that questions of safety and risk should be determined by experts who establish standards that the business is required to meet.

Answer the following statement true (T) or false (F)

What are some of the areas where the board determines corporation policy?

A) Selecting and removing officers B) Setting management compensation C) Initiating fundamental changes and declaring dividends D) All of these.

What is a primary difference between an industrial distributor and a manufacturers' agent?

A. A manufacturers' agent does not acquire title nor usually take possession of the products whereas an industrial distributor does. B. A manufacturers' agent is employed by the manufacturers while an industrial distributor is independent. C. An industrial distributor is employed by the manufacturers while a manufacturers' agent is independent. D. A manufacturers' agent rarely adds any value to the marketing channel while an industrial distributor reduces costs significantly. E. An industrial distributor does not form relationships with customers for repeat business whereas a key asset of a manufacturers' agent is his knowledge of his customers.