If firms make a profit in the short run, firms will exit the market in the long run.

Answer the following statement true (T) or false (F)

False

You might also like to view...

Which of the following correctly describes a way in which deficit spending can impose a burden on future generations?

I. Failure to allocate deficit spending to uses that boost future real Gross Domestic Product (GDP) will require taxing future generations at a higher rate to repay the resulting higher public debt. II. Government deficits that lead to higher employment and real Gross Domestic Product (GDP) in the future will generate increased income taxes for future governments, which will respond by spending the higher tax revenues, creating higher future government budget deficits. III. Other things being equal, deficit spending fuels increased consumption of goods and services by the current generation that crowds out capital investment, thereby leaving future generations with a smaller stock of capital than otherwise would have existed. A) I only B) II only C) I and III only D) II and III only

Differences in human capital are usually large and easily observable

Indicate whether the statement is true or false

Unreimbursed medical expenses in excess of 8.5% of AGI are tax deductible.

A. True B. False C. Uncertain

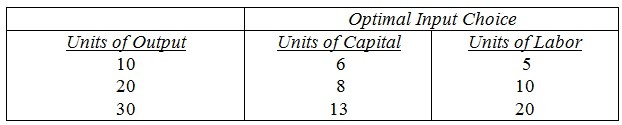

Following is a firm's expansion path. The price of capital is $5 per unit; the price of labor is $2 per unit.  How much does the 10th unit of output add to long-run total cost?

How much does the 10th unit of output add to long-run total cost?

A. $3 B. $40 C. zero D. $4 E. none of the above