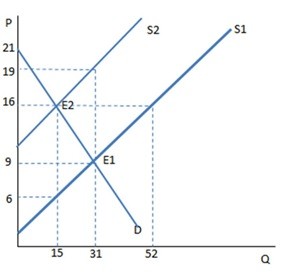

The graph shown demonstrates a tax on sellers. What is the amount of tax revenue being generated from the tax?

The graph shown demonstrates a tax on sellers. What is the amount of tax revenue being generated from the tax?

A. $310

B. $135

C. $80

D. $150

Answer: D

You might also like to view...

The Keynesian AD curve differs from the classical AD curve in that:

a. the classical AD curve can shift in response to non-monetary shocks. b. the Keynesian AD curve can shift in response to monetary shocks. c. the Keynesian AD curve can shift in response to non-monetary shocks. d. there is no difference, both are determined by the quantity theory. e. none of the above.

Explain why insurance companies usually do not offer earthquake insurance

What will be an ideal response?

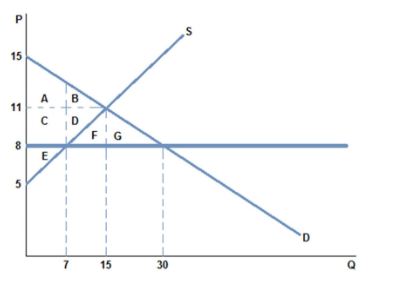

Which of the following changes to the market in the graph shown could cause the price ceiling to become non-binding?

A. Demand could increase, and shift to the right.

B. Supply could increase, and shift to the left.

C. Supply could increase, and shift to the right.

D. Supply could decrease, and shift to the left.

An example of a transaction that will be a surplus item on the U.S. balance of payments is

A) a U.S. resident purchasing French wine. B) a French subsidiary's plant in New Jersey purchasing parts from the main plant in Paris. C) a gift of wheat from the U.S. government to India. D) a tourist from Germany buying a ticket to fly from New York to Chicago on American Airlines.