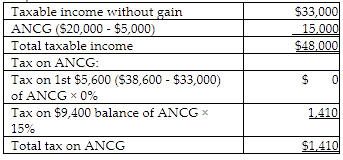

Sachi is single and has taxable income of $33,000 without considering the sale of a capital asset in November of 2018 for $20,000. That asset was purchased six years earlier and has a tax basis of $5,000. The tax liability applicable to only the capital gain is

A) $0.

B) $2,250.

C) $3,000.

D) $1,410.

D) $1,410.

ANCG is taxed at 0% to the extent it brings taxable income up to $38,600, with the portion causing taxable income to exceed $38,600 taxed at 15%.

You might also like to view...

The Health Care Reform Act is an amendment of the ________ Act

A) Consumer Product Safety B) Patient Protection and Affordable Care C) Medical Device Amendment D) Federal Trade Commission

When a salesperson calls you to sell a cemetery plot, this is most likely what type of product?

A. unsought product B. secondary product C. convenience product D. shopping product E. line extension

As an alternative to demutualizing, Big Mutual Insurance Company reorganized itself into a corporate form that can directly or indirectly own a stock insurance company. This form of organization is called a(n)

A) holding company. B) shell company. C) upstream company. D) downstream company.

Many states permit a corporate board to have fewer than three directors

Indicate whether the statement is true or false