Assume that the central bank purchases government securities in the open market. If the nation has highly mobile international capital markets and a flexible exchange rate system, what happens to the quantity of real loanable funds per time period and reserve-related (central bank) transactions in the context of the Three-Sector-Model?

a. The quantity of real loanable funds per time period falls, and reserve-related (central bank) transactions remains the same.

b. The quantity of real loanable funds per time period falls, and reserve-related (central bank) transactions become more negative (or less positive).

c. The quantity of real loanable funds per time period rises, and reserve-related (central bank) transactions remains the same.

d. There is not enough information to determine what happens to these two macroeconomic variables.

e. The quantity of real loanable funds per time period and reserve-related (central bank) transactions remain the same.

.C

You might also like to view...

Refer to the scenario above. Robert should use ________ to play this game

A) forward induction B) backward induction C) mixed strategies D) his dominated strategy

An analysis of the incidence of a unit tax on suppliers versus a unit tax on demanders shows us that the _____ of a tax may be different from the _____ of a tax

a. actual burden; distribution b. payment; distribution c. amount; incidence d. actual burden; legal assignment

Which of the following is not a problem from incurring debt?

a. everyone has less current income b. it promotes overconsumption c. it can cause inflation d. private investment may be reduced e. future consumption may be reduced

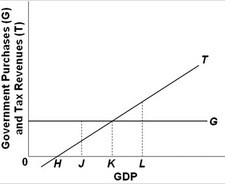

Refer to the above graph. A budget deficit would be associated with GDP level:

Refer to the above graph. A budget deficit would be associated with GDP level:

A. L. B. K. C. J. D. no GDP level.