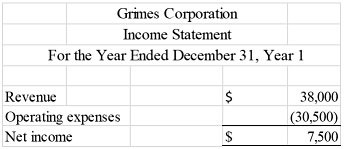

Grimes Corporation reports the following cash transactions for the year ending December 31, Year 1, its first year of operation:1) Issued common stock for $35,0002) Borrowed $25,000 from a local bank3) Purchased land for $40,0004) Provided services to clients for $38,0005) Paid operating expenses of $30,5006) Paid $2,000 cash dividends to stockholdersRequired:a) What are the total assets for Grimes Corporation at December 31, Year 1?b) Prepare an income statement for Year 1.

What will be an ideal response?

a) Total assets = $35,000 + $25,000 + $38,000 ? $30,500 ? $2,000 = $65,500

b)

You might also like to view...

The treatment of each independent variable in this manner conforms to the straightline assumptions of multiple regression analysis. This is sometimes known as additivity, because each new independent variable is added on to the regression equation

Indicate whether the statement is true or false

The sales presentation provides salespeople with very little opportunity to influence a prospect.

Answer the following statement true (T) or false (F)

Under the Clayton Act, a seller can condition the sale of a product on the buyer’s promise not to deal in the goods of the seller’s competitors.

Answer the following statement true (T) or false (F)

On April 1, Year 1, Fossil Energy Company purchased an oil producing well at a cash cost of $7,140,000. It is estimated that the oil well contains 660,000 barrels of oil, of which only 560,000 can be profitably extracted. By December 31, Year 1, 28,000 barrels of oil were produced and sold. What is depletion expense for Year 1 on this well? (Do not round intermediate calculations.):

A. $357,000 B. $119,000 C. $302,909.091 D. $476,000