Kathleen received land as a gift from her grandfather. At the time of the gift, the land had a FMV of $85,000 and an adjusted basis of $110,000 to Kathleen's grandfather. One year later, Kathleen sold the land for $80,000. What was her gain or (loss) on this transaction?

A. $30,000

B. ($5,000)

C. no gain or loss

D. $5,000

Answer: B

You might also like to view...

The "Got Milk" campaign was intended to boost sagging milk consumption among Californians in the 1990s

The campaign ads highlighted the inconvenience of running out of milk when intended to be used with certain foods, such as cookies or muffins, advising consumers to stock up on milk to avoid such inconveniences. The "Got Milk?" campaign is an example of ________ advertising. A) informational B) reminder C) institutional D) comparative E) reinforcement

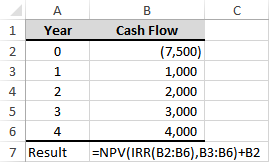

What is the result in B7?

a) 2,316.35

b) 27.27%

c) -2,316.35

d) -14.36%

e) 0

Dividends Payable is an example of a(n)

a. contingent liability. b. definitely determinable liability. c. estimated liability. d. long-term liability.

Which of the following is an expanded form of calculating return on investment?

A) Profit margin ratio x Asset turnover ratio B) Net profit ratio x Inventory turnover ratio C) Gross profit ratio x EVA D) Asset turnover ratio x Inventory turnover ratio