Why is it necessary to separate the management function in an organization from those of finance and residual claimancy?

Separation of the management function from those of finance and residual claimancy is essential because:

a) The skills and opportunity costs of management is entirely different from that of the residual claimants.

b) Residual claimants who have interests in more than one firm are diversified in ways that managers who depend on a single employer for most of their incomes cannot be.

c) A diversified residual claimant generally has less understanding of the firm than a manager and has little knowledge that is likely to improve the quality of the manager's choices.

You might also like to view...

In October of 20142, the interest rate on money market accounts was about 0.2 percent. In 2007, the interest rate on money market accounts was about 4.0 percent

What has been the impact on the demand for money curve from this fall in the interest rate? A) the money demand curve shifted to the right B) the money demand curve shifted to the left C) there was a downward movement along the demand for money curve D) there was an upward movement along the demand for money curve

In the Keynesian cross diagram, an increase in autonomous consumer expenditure causes the aggregate demand function to shift up, the equilibrium level of aggregate output to ________, and the IS curve to shift to the ________,

everything else held constant. A) rise; left B) rise; right C) fall; left D) fall; right

Explain how compensating differentials could contribute to differences between the average wages of men and women

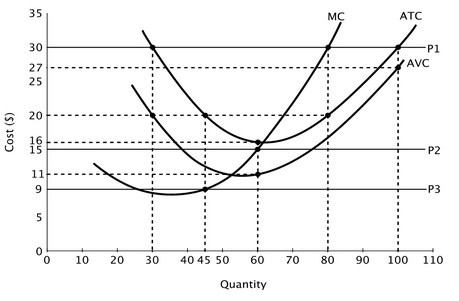

Refer to the accompanying graph. If this firm is a price taker and the price of each unit of output is $9, then this firm should:

A. produce 45 units of output. B. raise its price to increase its revenue. C. lower its output to decrease its marginal cost. D. shut down in the short run.