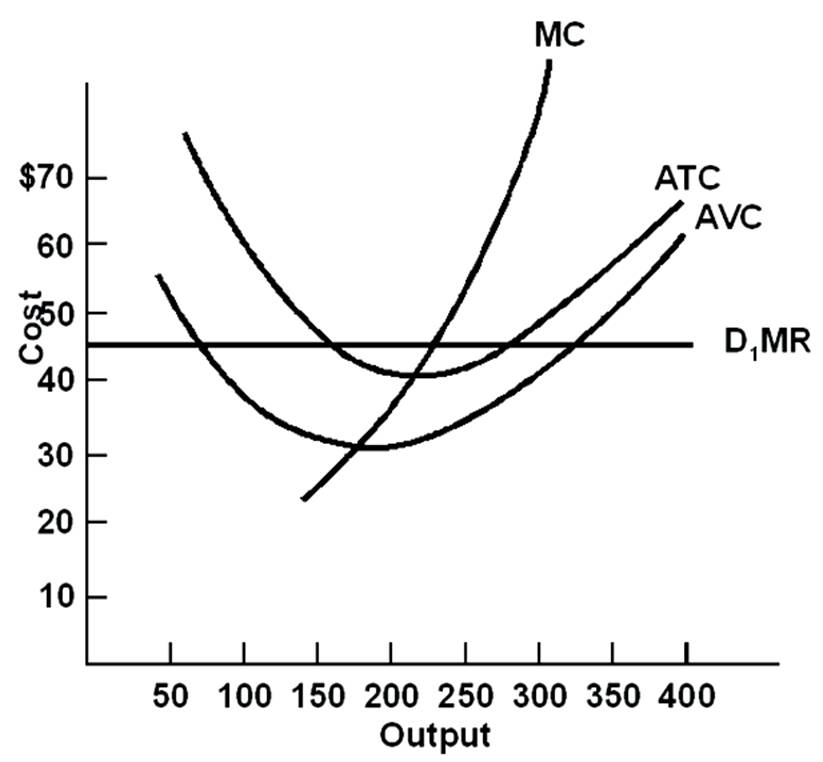

The firm's long-run supply curve begins at an output of

A. 100.

B. 150.

C. 215.

D. 300.

C. 215.

You might also like to view...

The demand and the supply for a good are each neither perfectly elastic nor perfectly inelastic. If a sales tax on sellers of the good is imposed, the tax is paid by

A) only buyers. B) only sellers. C) both buyers and sellers. D) neither buyers nor sellers.

Which statement explains why monopolists are not productively efficient?

a. Monopolists do not produce at the minimum of the average cost curve. b. Monopolists produce at the quantity where P = MC. c. Monopolists spend too much on developing innovative products. d. Monopolists produce too many goods at a lower average cost.

Which of the following categories of taxes provides funds for Social Security and Medicare?

a. Personal income tax b. Corporate income tax c. Excise tax d. Payroll tax

A payroll tax with a 4.5 percent tax rate and exemption for income above $42,000 is

A. a progressive tax. B. an indirect tax. C. a regressive tax. D. a proportional tax.