Explain why a bank with a high debt-to-equity ratio may be more profitable than a bank with a lower ratio but would also have a higher level of risk.

What will be an ideal response?

A bank with a high debt-to-equity ratio is financing the acquisition of assets with borrowed funds. The return (profit) earned on these assets belong to the owners (the providers of the bank's capital or equity). With a high debt-to-equity ratio, the owners of the bank stand to earn a higher return on equity than the owners of a bank with a lower debt-to-equity ratio, assuming the same return on assets. The problem or the risk comes from the fact that with the high leverage anything that reduces the value of assets can potentially wipe out the capital of the bank, leaving the bank insolvent since the capital cushion is inadequate to meet the drop in asset value.

You might also like to view...

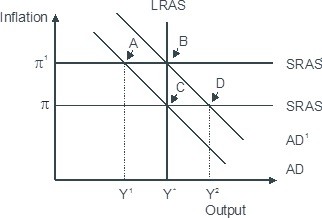

Based on the figure below. Starting from long-run equilibrium at point C, an increase in government spending that increases aggregate demand from AD to AD1 will lead to a short-run equilibrium at point ________ creating _____gap.

A. D; an expansionary B. B; no output C. B; expansionary D. A; a recessionary

Steve buys Pepsi at $.60 per can and orange juice at $1.20 per can. In consumer equilibrium,

a. orange juice would yield a higher marginal utility per dollar spent than Pepsi would b. he will consume twice as much Pepsi as orange juice c. he will consume more orange juice than Pepsi d. total utility from orange juice is twice that from Pepsi e. his last can of orange juice would generate a higher marginal utility than his last can of Pepsi

The current price of concert t-shirts is $20 each, and the company has been selling 400 per week. If price elasticity is 2.5 and the price changes to $21, how many t-shirts will be sold per week?

With regard to exchange rate determination, the law of one price is a useful theory only when applied to:

A. long-run periods of time. B. forward exchange rates. C. futures contracts. D. very short-run periods of time.