If the government decreases the income tax rate, then:

A. GDP will decrease.

B. aggregate demand will shift left.

C. aggregate demand will shift right.

D. aggregate supply curve with shift to the right.

C. aggregate demand will shift right.

You might also like to view...

Which of the following will cause an outward (rightward) shift in the supply curve?

A) a reduction in the price of the good B) an increase in the price of labor input C) an increase in the number of consumers D) technological progress

Which of the following would be an example or result of expansionary fiscal policy in action?

a. an increase in taxation b. a decrease in government purchases c. a budget deficit d. a budget surplus

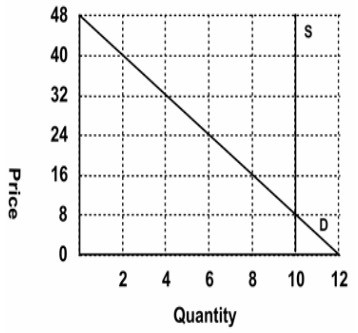

Refer to the following graph. Which of the following pairs of equations describes the supply and demand curves?

Which of the following pairs of equations describes the supply and demand curves?

A. Qs = P; Qd = 0.25P + 22, respectively B. Qs = 10; Qd = 48 ? 2P, respectively C. Qs = 10; Qd = 12 ? 0.25P, respectively D. Cannot be determined

If there is a decrease in the percentage of employees whose wages adjust automatically with changes in the price level, the aggregate supply curve will become

A. horizontal. B. steeper. C. flatter. D. vertical.