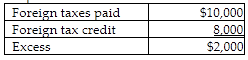

Ashley, a U.S. citizen, works in England for part of the year. She earns $40,000 in England, paying $10,000 in income taxes to the British government. Her U.S. income is $60,000 and she pays $12,000 in U.S. taxes. Her U.S. taxes on her worldwide income are $20,000. What is Ashley's excess foreign tax credit? Assume she does not qualify for the foreign-earned income exclusion.

A) $0

B) $2,000

C) $4,000

D) none of the above

B) $2,000

You might also like to view...

________ refers to a court's jurisdiction over the parties to a lawsuit.

A. In rem jurisdiction B. Quasi in rem jurisdiction C. In personam jurisdiction D. Sua sponte

In a short essay, define and discuss the difference between immoral, amoral, and moral management styles.

What will be an ideal response?

When Disney seeks to attract European families by advertising specially priced tourist packages, what global marketing environment factor are they using?

A. lowered trade barriers B. income distribution levels C. currency fluctuation D. cultural fit E. international economic cooperation

Which of the following is not included in continuing operations?

A) gain on sale of machinery B) a segment of a business that has been discontinued C) cost of goods sold D) losses due to lawsuits