Milford Lighting Supply expects the following for 2016

Net cash provided by operating activities of $281,000

Net cash provided by financing activities of $65,000

Net cash provided by investing activities of $85,000

Cash dividends paid to stockholders of $24,000

Milford expects to spend $157,000 to modernize its showroom.

How much free cash flow does Milford expect for 2016?

A) $124,000

B) $277,000

C) $100,000

D) $107,000

C .C) Free cash flow = Net cash provided by operating activities - Cash payments planned for investments in long-term assets - Cash dividends

Free cash flow = $281,000 - $157,000 - $24,000

Free cash flow = $100,000

You might also like to view...

In Unified Modeling Language (UML) primary keys cannot by NULL.

Answer the following statement true (T) or false (F)

Prepare the investing activities section of the statement of cash flows.

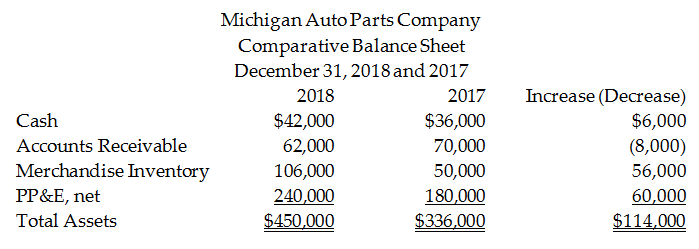

Michigan Auto Parts Company uses the indirect method to prepare its statement of cash flows. Refer to the following portion of the comparative balance sheet:

Additional information provided by the company includes the following:

Equipment costing $104,000 was purchased for cash.

Equipment with a net book value of $20,000 was sold for $28,000.

Depreciation expense of $24,000 was recorded during the year.

When a company discards machinery that is fully depreciated, this transaction would be recorded with the following entry

A) debit Accumulated Depreciation; credit Machinery B) debit Machinery; credit Accumulated Depreciation C) debit Cash; credit Accumulated Depreciation D) debit Depreciation Expense; credit Accumulated Depreciation

Kollo Enterprises has a beta of 0.70, the real risk-free rate is 2.00%, investors expect a 3.00% future inflation rate, and the market risk premium is 4.70%. What is Kollo's required rate of return? Do not round your intermediate calculations.

A. 7.96% B. 7.30% C. 6.47% D. 6.96% E. 8.29%