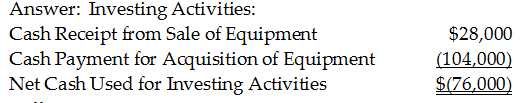

Prepare the investing activities section of the statement of cash flows.

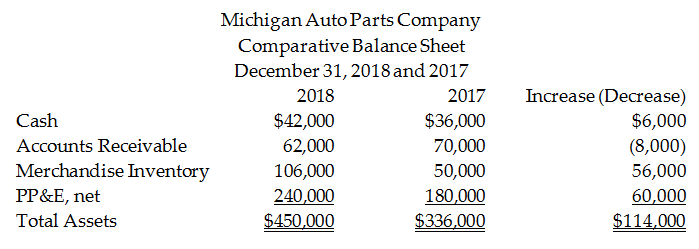

Michigan Auto Parts Company uses the indirect method to prepare its statement of cash flows. Refer to the following portion of the comparative balance sheet:

Additional information provided by the company includes the following:

Equipment costing $104,000 was purchased for cash.

Equipment with a net book value of $20,000 was sold for $28,000.

Depreciation expense of $24,000 was recorded during the year.

You might also like to view...

Which of the Big Five personality factors means the tendency to be anxious, vulnerable, or depressed?

A. extraversion B. determination C. conscientiousness D. neuroticism

Which of the following offers an example where Porter's five forces are mostly strong and competition is high?

A. A professional hockey team. B. A ski resort. C. A dog walking business. D. All of these.

Under current U.S. GAAP unrealized gains and losses from four balance sheet items are reported in accumulated other comprehensive income or loss. Which of the following is not one of the balance sheet items?

a. Derivatives held as cash flow hedges. b. Deferred tax assets related to net operating loss carryforwards. c. Minimum pension obligations. d. Investment securities classified as available for sale.

At December 31, 2018, Micro Instruments owes $47,000 on Accounts Payable. The balance of Salaries Payable is $14,000 and the balance of Income Tax Payable is $8,000. Micro also has $250,000 of Bonds Payable that were issued at face value. These bonds require payment of a $25,000 installment next year and payment of the remainder in later years. The bonds payable require an annual interest payment of $7,500. Micro still owes this for the current year.

Requirement: Report Micro Instruments' liabilities on its classified balance sheet on December 31, 2018.