If a tax is placed on perfectly competitive firms that impose external costs on society, the firm's marginal cost curve will shift ________ and the industry supply curve will shift to the ________.

A. up; left

B. down; right

C. down; left

D. up; right

Answer: A

You might also like to view...

If an abatement standard is set to achieve allocative efficiency at the national level, then

a. that standard necessarily achieves allocative efficiency in all regions b. the standard cannot be optimal at the regional level unless the MSB and MSC for all regions are identical to one another c. all regions will abate below the optimal level d. at that abatement standard, all regions will face MSC higher than MSB

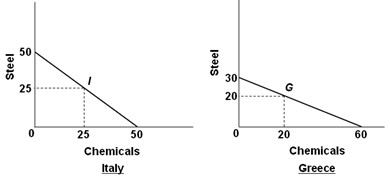

Use the following graphs of production possibilities curves to answer the next question. Suppose the world economy is composed of just two countries: Italy and Greece. Each can produce steel or chemicals, but at the different levels of economic efficiency shown in the graphs. It can be deduced that

Suppose the world economy is composed of just two countries: Italy and Greece. Each can produce steel or chemicals, but at the different levels of economic efficiency shown in the graphs. It can be deduced that

A. Greece has a comparative advantage in chemicals. B. it is more costly in terms of resources to produce steel in Italy. C. Greece has the absolute advantage in both products. D. Italy has a comparative advantage in chemicals.

The marginal propensity to import is larger in Mexico than in the United States. As a result,

A) there is less autonomous investment in Mexico. B) the expenditure multiplier is larger in Mexico. C) the expenditure multiplier is larger in the United States. D) induced expenditure is larger in Mexico. E) there is more autonomous expenditure in Mexico.

Unreimbursed medical expenses in excess of 8.5% of AGI are tax deductible.

A. True B. False C. Uncertain