_____ is the first step of the AIDA model.

A. Interest

B. Desire

C. Attention

D. Action

C. Attention

You might also like to view...

The Computer Fraud and Abuse Act:

A. prohibits interference with computers used by the government or financial institutions. B. includes only criminal penalties. C. enables providers to disclose the contents of electronic communication to intelligence officials under any circumstance. D. prohibits an authorized person from unknowingly transmitting a code to a computer used in interstate commerce.

Tough Steel, Inc. is a processor of carbon, aluminum, and stainless steel products. The firm is considering replacing an old stainless steel tube-making machine for a more cost-effective machine that can meet the firm’s quality standards. The old machine was acquired 2 years ago at an installed cost of $500,000. It has been depreciated under the MACRS’s 5-year recovery period, and has a remaining economic life of 5 years. It can be sold today for $350,000 before taxes, but if the firm decides to keep it, it can be sold for $100,000 before taxes at the end of year 5.

The first option is Machine A, which can be purchased for $600,000, but will require $30,000 in installation costs. This machine would be depreciated under the MACRS’s 3-year recovery period. At the end of its economic life, the machine will have a salvage value of $350,000 before taxes. This machine would require an investment in net working capital of $100,000.

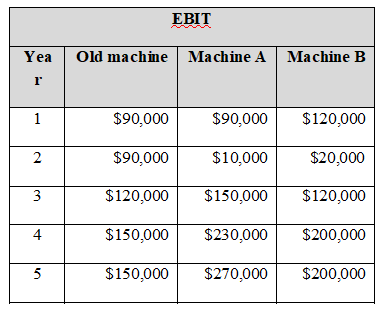

The second option is Machine B, which can be purchased for $550,000, but requires $20,000 in installation costs. This machine would be depreciated under the MACRS’s 5-year recovery period. At the end of its economic life, the machine would have a salvage value of $330,000 before taxes. This machine requires no investment in net working capital. The firm has estimated the following EBIT for all three machines:

a) Determine which machine is more profitable for the company based on the payback period, discounted payback period, net present value, profitability index, internal rate of return, and modified internal rate of return.

What are some of the key elements that need to be kept in mind during the design phase of the SDLC? Discuss

What will be an ideal response?

For a company that makes short-term loans, 20 minutes are required to review the loan, and 30 minutes to check credit; 10 employees who can check credit and 5 employees who can review loans are available, and it costs $50 for each loan. Which of the following would be included in the objective function?

A) The 20 minutes to review B) The 30 minutes to credit check C) 10 employee credit checkers D) 5 employee reviewers E) $50 loan cost