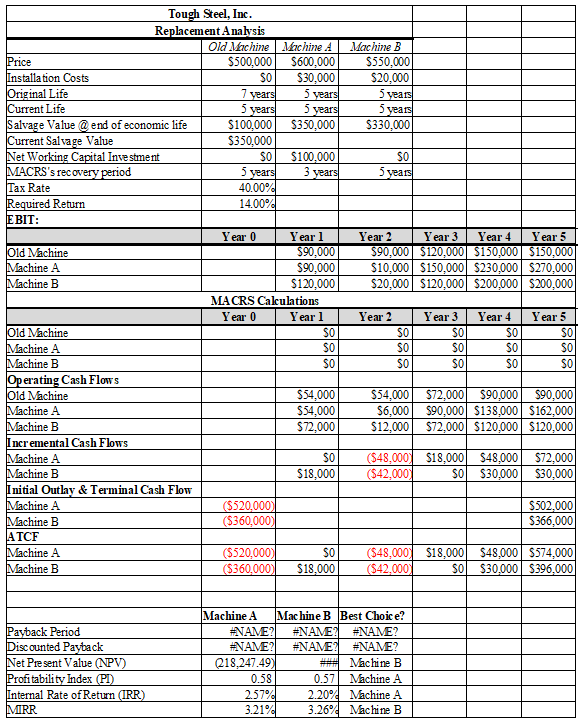

Tough Steel, Inc. is a processor of carbon, aluminum, and stainless steel products. The firm is considering replacing an old stainless steel tube-making machine for a more cost-effective machine that can meet the firm’s quality standards. The old machine was acquired 2 years ago at an installed cost of $500,000. It has been depreciated under the MACRS’s 5-year recovery period, and has a remaining economic life of 5 years. It can be sold today for $350,000 before taxes, but if the firm decides to keep it, it can be sold for $100,000 before taxes at the end of year 5.

The first option is Machine A, which can be purchased for $600,000, but will require $30,000 in installation costs. This machine would be depreciated under the MACRS’s 3-year recovery period. At the end of its economic life, the machine will have a salvage value of $350,000 before taxes. This machine would require an investment in net working capital of $100,000.

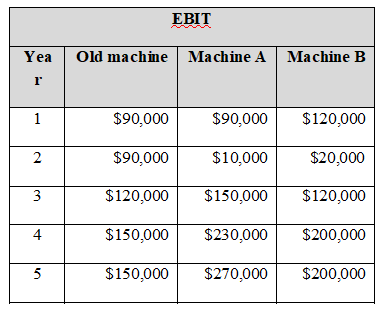

The second option is Machine B, which can be purchased for $550,000, but requires $20,000 in installation costs. This machine would be depreciated under the MACRS’s 5-year recovery period. At the end of its economic life, the machine would have a salvage value of $330,000 before taxes. This machine requires no investment in net working capital. The firm has estimated the following EBIT for all three machines:

a) Determine which machine is more profitable for the company based on the payback period, discounted payback period, net present value, profitability index, internal rate of return, and modified internal rate of return.

You might also like to view...

Sales promotion programs targeted at marketing intermediaries such as wholesalers, distributors, and retailers are part of

A. trade-oriented sales promotion. B. consumer-oriented sales promotion. C. intrinsic sales promotion. D. user-oriented sales promotion. E. bait-and-switch sales promotion.

On November 5, 2014, a Longhaul Rental truck was in an accident with an auto driven by Alana Rodriguez. Longhaul Rental received notice on January 12, 2015, of a lawsuit for $700,000 damages for personal injuries suffered by Rodriguez. Longhaul Rental's counsel believes it is probable that Rodriguez will be awarded an estimated amount in the range between $300,000 and $550,000, and that $400,000

is a better estimate of potential liability than any other amount. Longhaul's accounting year ends on December 31 . and the 2014 financial statements were issued on March 2, 2015 . What amount of loss should Longhaul accrue at December 31 . 2014? a. $0 b. $300,000 c. $400,000 d. $550,000

The use of internal controls provides a guarantee against losses due to operating activities.

Answer the following statement true (T) or false (F)

Two different individuals or companies can go to the same bank and request exactly the same amount of funding for their projects and yet can be required to pay different costs for their funds

Why? Can we find a parallel situation in the bond and equity markets? Explain. What will be an ideal response?