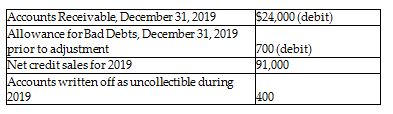

The following information is from the records of Chicago Photography:

Bad debts expense is estimated by the aging-of-receivables method. Management estimates that $2950 of accounts receivable will be uncollectible. Calculate the amount of net accounts receivable after the adjustment for bad debts.

A) $21,750

B) $21,050

C) $20,350

D) $19,950

B) $21,050

You might also like to view...

Marks Consulting purchased equipment costing $45,000 on January 1, Year 1. The equipment is estimated to have a salvage value of $5,000 and an estimated useful life of 8 years. Straight-line depreciation is used. If the equipment is sold on July 1, Year 5 for $20,000, the journal entry to record the sale will include a:

A. Debit to accumulated depreciation for $22,500. B. Debit to gain on sale for $2,500. C. Debit to loss on sale for $10,000. D. Credit to loss on sale for $10,000. E. Credit to cash for $20,000.

Which of the following describes ‘a naturally occurring and evolving collection of people who together engage in particular kinds of activity, and who come to develop and share ways of doing things – ways of talking, beliefs, values, and practices – as a result of their joint involvement in that activity’ (Galagan, 1993: 33):

a. communities of practice b. communities of experience c. high-performance work teams d. knowledge hives

Business and organizational customers are selective buyers who buy for the sole purpose of resale.

Answer the following statement true (T) or false (F)

Small business owners have a number of retirement plans available to them. One type of plan is limited to employers with 100 or fewer eligible employees

Under this type of plan, small employers are exempt from most of the nondiscrimination and administrative rules that apply to qualified plans. Such plans are called A) Keogh plans. B) SIMPLE retirement plans. C) cash balance plans. D) profit sharing plans.