The tax rates embodied in the federal personal income tax are such that

A. a rising absolute amount, but a declining proportion, of income is paid in taxes.

B. the marginal and average tax rates are equal, making the tax progressive.

C. the average tax rate rises more rapidly than does the marginal tax rate.

D. the marginal tax rate is higher than the average tax rate, causing the average tax rate to rise.

D. the marginal tax rate is higher than the average tax rate, causing the average tax rate to rise.

You might also like to view...

Rachel usually takes long coffee breaks and works less whenever her boss is out of town for business

However, she started taking shorter breaks when the Human Resource Manager at her company announced that each employee will henceforth be paid a performance-based incentive every month. What explains her behavior before and after the announcement of the new policy?

Price controls involve the use of the power of the state to establish prices different from the ______ prices that would otherwise prevail.

a. demand b. supply c. indeterminate d. equilibrium

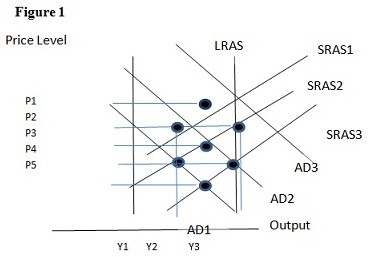

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the short run would be:

A. P1 and Y2. B. P3 and Y1. C. P2 and Y2. D. P2 and Y3.

If the Federal Reserve wants to decrease the money supply, it should:

A. decrease the discount rate. B. conduct open-market sales. C. decrease the interest that it pays on reserves. D. decrease reserve requirements.