?Bunsen Company is involved in a consumer liability lawsuit. Company attorneys have assessed the contingent outcomes of the lawsuit. Because the attorneys think the company will probably lose the lawsuit, To prepare for this loss, Bunsen management has decided to set aside funds in an investment account that earns a 9% return rate. Furthermore, there is general agreement that there is a 60% probability the company will have to pay the defendants $6 million four years from now; a 30% probability the company will need to pay $10 million eight years from now, and a 10% probability the company will pay nothing. What amount should Bunsen accrue as a contingent liability?

A. ?$4,055,928

B. ?$6,179,473

C. ?$6,600,000

D. ?$9,269,210

Answer: A

You might also like to view...

Locate the point on the rectangular coordinate system. (0, 2)

(0, 2)

A. C B. K C. B D. F

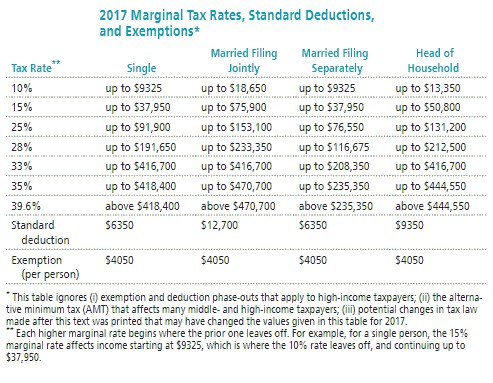

Solve the problem. Refer to the table if necessary. Jim earned wages of

Jim earned wages of  received

received  in interest from a savings account, and contributed

in interest from a savings account, and contributed  to a tax deferred retirement plan. He was entitled to a personal exemption of

to a tax deferred retirement plan. He was entitled to a personal exemption of

style="vertical-align: -4.0px;" /> and had deductions totaling  Find his adjusted gross income.

Find his adjusted gross income.

A. $93,729

B. $97,779

C. $84,561

D. $110,613

Compute the total and annual returns on the described investment.Seven years after paying $5603 for shares in a new company, you sell the shares for $18,621.

A. Total Return: 243.96% Annual Return: 19.65% B. Total Return: 232.34% Annual Return: 18.72% C. Total Return: 220.72% Annual Return: 17.78% D. Total Return: 185.87% Annual Return: 14.97%

Provide an appropriate response.The lump sum deposit that would give you the same end result as regular payments into a savings plan is called the _____ of the savings plan.

A. future value B. total value C. present value D. None of the above