Whitestone Products is considering a new project whose data are shown below. The required equipment has a 3-year tax life, and the accelerated rates for such property are 33.33%, 44.45%, 14.81%, and 7.41% for Years 1 through 4. Revenues and other operating costs are expected to be constant over the project's 10-year expected operating life. What is the project's Year 4 cash flow?

Equipment cost (depreciable basis)$70,000

Sales revenues, each year$42,500

Operating costs (excl. deprec.)$25,000

Tax rate25.0%

A. $13,016

B. $13,701

C. $14,422

D. $15,143

E. $15,900

Answer: C

You might also like to view...

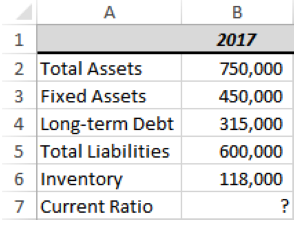

What is the correct formula for cell B7?

a) =(B2+B3)/(B5-B4)

b) =(B2-B3)/(B5+B4)

c) =(B2-B6)/(B5-B2)

d) =(B2-B3)/(B5-B4)

e) =(B2+B3)/(B5+B4)

Kaizen costing helps to

a. reduce product costs of products in the design and development stage. b. keep the target cost as the primary focus after a product enters production. c. keep profit margin relatively stable as product price declines over the product life cycle. d. reduce the cost of engineering change orders during each stage of the product life cycle.

A definition of culture does not include ______.

A. individual qualities B. customs and scripts of a group C. traditions that are shared by a group D. learned beliefs and values

Anticipatory avoidance cannot be claimed if the specific goods promised to the buyer are wrongfully sold to a third party

Indicate whether the statement is true or false