A producer sells an item to a wholesaler for $4.00, and the wholesaler uses a markup of 25 percent on its selling price and the retailer uses a markup of 30 percent on its selling price. What will be the retailer's selling price to its customers?

A. $7.61

B. $7.36

C. $7.55

D. $7.24

E. $7.12

Answer: A

You might also like to view...

Many services are performed by humans. As a result, they can vary from purchase occasion to occasion. This characteristic of services is referred to as:

A) inseparability. B) intangibility. C) nonstandardization. D) difficulty of inventorying.

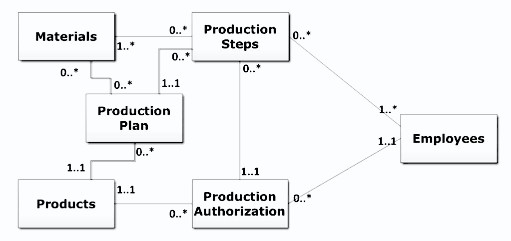

The link between the Production Plan and Materials tables would be implemented as a linking table.

The link between the Production Plan and Materials tables would be implemented as a linking table.

Answer the following statement true (T) or false (F)

Answer the following statements true (T) or false (F)

1. To calculate budgeted direct labor costs, multiply the number of units to be produced by the number of projected direct labor hours. Next, multiply that total by the actual direct labor cost per hour. 2. To calculate budgeted direct labor costs, multiply the number of units to be produced by the number of projected direct labor hours. Next, multiply that total by the average direct cost per hour. 3. The manufacturing overhead budget calculates the budgeted overhead cost for the year and also the predetermined overhead allocation rate for the year. 4. The manufacturing overhead budget calculates the budgeted overhead cost for the year, but not the predetermined overhead allocation rate for the year. 5. In preparing the master budget, the manufacturing overhead is the last period cost to consider.

The seller might offer a(n) ________to a buyer that is not satisfied with the goods received.

Fill in the blank(s) with the appropriate word(s).