A vacation home in Malibu is

a. not rival in consumption and excludable.

b. rival in consumption and excludable.

c. not rival in consumption and not excludable.

d. rival in consumption and not excludable.

b

You might also like to view...

Because Federal Reserve Notes (paper currency) are legal tender,

A) U.S. creditors must accept them in payment of debts. B) U.S. workers must accept them as payment for labor services. C) U.S. firms must accept them as payment for goods and services. D) All of he above are correct.

Cameron can spend the afternoon playing golf, driving his boat, or cleaning his house. Although he enjoys golf, he sometimes becomes frustrated when playing. He decides to enjoy a more relaxing afternoon on his boat. Cameron never thought about cleaning the house but did give golf some serious consideration. Cameron's opportunity cost of taking his boat out was:

A. a dirty house from deciding not to clean it. B. the enjoyment he would have gotten from playing golf. C. a dirty house and not playing golf. D. enjoying a relaxing day on the lake.

Taxes constitute the difference between GDP and disposable income

a. True b. False Indicate whether the statement is true or false

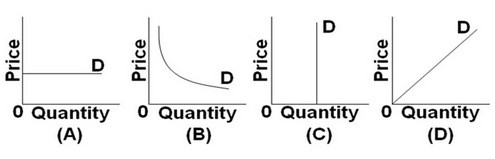

Refer to the above graphs. A price increase from $20 to $40 causes quantity demanded to decrease from 100 units to 50 units. Which graph best illustrates the price elasticity of demand for this good?

A. Graph A

B. Graph B

C. Graph C

D. Graph D