Taking advantage of the built-in-loophole in emission taxes implies

A. opportunity to save on taxes by reducing emissions.

B. opportunity to avoid taxes even without cutting emissions.

C. opportunity to increase emission by paying more tax.

D. opportunity to pay less by increasing emission.

Answer: A

You might also like to view...

Cyclical unemployment:

a. causes unemployment statistics to be understated. b. causes unemployment statistics to be overstated. c. occurs because of recessions. d. occurs because of technological innovations in production. e. only occurs with a zero inflation rate.

All of the following cost curves are U-shaped except

A) the marginal cost curve. B) the average fixed cost curve. C) the average total cost curve. D) the average variable cost curve.

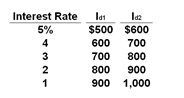

The table gives data on interest rates and investment demand (in billions of dollars) in a hypothetical economy.

Refer to the above table. Assume that the public debt is used to expand the capital stock of the economy and that, as a consequence, the investment-demand schedule changes from Id1 to Id2. At the same time, the interest rate rises from 3% to 4% as the government borrows money to finance the public debt. How much crowding out of private investment will occur in this case?

A. $0

B. $100 billion

C. $600 billion

D. $700 billion

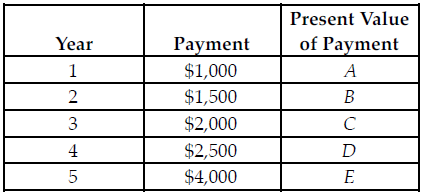

Refer to the table below. What is the value of A plus B plus C (A + B + C) or the present value of the first three payments?

The above table shows a 5 year payment plan. Each payment is made at the end of the year, so after one year, a payment of $1,000 is made, after two years another payment of $1,500 is made and so on. The interest rate is 3 percent.

A) $4,215.05

B) $4,100.50

C) $4,426.89

D) $3,998.