A quota is

A. a tax on exported items.

B. a tax on imported items.

C. a limit on the amount of imports.

D. a subsidy to export.

Answer: C

You might also like to view...

Answer the following statement(s) true (T) or false (F)

1. When suppliers are not satisfied, they lower their prices to attract more demanders. 2. If the demand for a good is high, then there will be a shortage of that good. 3. The equilibrium price of a good will rise in response to either a rise in demand or a fall in supply. 4. When a sales tax of 50¢ per carton is imposed on cigarettes, the equilibrium price drops by precisely 50¢ per carton. 5. Suppliers of a commodity are better off whenever the legal incidence of a tax is shifted away from the suppliers to the demanders.

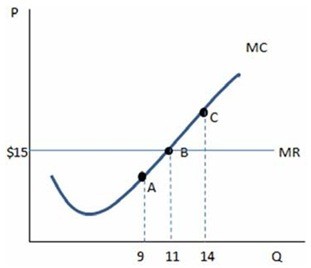

According to the graph shown, the market price is:

According to the graph shown, the market price is:

A. $11 B. $15 C. $9 D. $20

Other things the same, if the U.S. interest rate rises, what happens to the net capital outflow of other countries?

Which of the following is not held constant along a given demand curve for a good?

A. The price of substitute goods. B. Consumer's income. C. Price of the good itself (own price). D. Consumer tastes.