Unamortized bond discount is

a. a contra-liability account.

b. used to arrive at the carrying value of bonds.

c. increased with a debit entry when bonds are issued at a discount.

d. All of these are correct.

c

You might also like to view...

What effect will this adjustment have on the accounting records? Unearned Revenue 3,300 Fees earned 3,300

A) Increase net income B) Increase revenues reported for the period C) Decrease liabilities D) All are true.

"That's the way it has always been done," is a phrase that often signals ethical difficulties

Indicate whether the statement is true or false

Unearned revenues are generally:

A. Liabilities created when a customer pays in advance for products or services before the revenue is earned. B. Increases to owners' capital. C. Revenues that have been earned and received in cash. D. Recorded as an asset in the accounting records. E. Revenues that have been earned but not yet collected in cash.

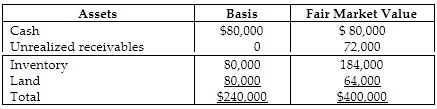

The partnership has no liabilities on the sale date. Tony's basis in his partnership interest on the date of the sale is $60,000. What is the allocation of Tony's gain to the assets received?

Tony sells his one-fourth interest in the WindyCity Partnership to Bill for $100,000 cash when the partnership's assets are as follows: