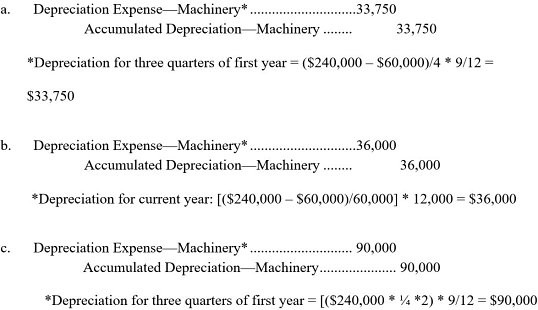

On April 1 of the current year, a company purchased and placed in service a machine with a cost of $240,000. The company estimated the machine's useful life to be four years or 60,000 units of output with an estimated salvage value of $60,000. During the current year, 12,000 units were produced. Prepare the necessary December 31 adjusting journal entry to record depreciation for the current year assuming the company uses:a. The straight-line method of depreciationb. The units-of-production method of depreciationc. The double-declining balance method of depreciation

What will be an ideal response?

You might also like to view...

Why do firms benefit from a price premium with loyal customers?

What will be an ideal response?

Which of the following is not considered an epolicy?

A. Ethical computer use policy B. Acceptable use policy C. Anti-hacker use policy D. Internet use policy

Find the average collection period for a firm that has credit sales of $120,000,000 and accounts receivable of $30,000,000

A) 30 days B) 120 days C) 90 days D) 45 days E) 60 days

After a lengthy market research study, J.W. Company, a large consumer products company, has determined that consumers in the market would respond favorably to a line of organic frozen entrees to complement J.W.'s current line of frozen food products. J.W's current production line would not allow for the additional products, so J.W. company must evaluate the cost of expanding their current

facility or expand to a new location. The company does own land just outside a small town about 30 miles from their corporate headquarters. Of course, building or expanding a new facility would require a significant capital investment. How will this decision likely affect customers of the company?? A) ?Increased pay B) ?Increased product choices C) ?Increased job opportunities D) ?Increased tax revenue E) ?Increased profits