John Maynard Keynes described periods of irrational pessimism and optimism that affect the investment behavior of firms as animal spirits. When considering the investment behavior of firms, animal spirits can be thought of as changes in the

A) actual marginal product of capital.

B) capital stock.

C) expected marginal product of capital.

D) user cost of capital.

C

You might also like to view...

Which of the following is true of fiscal spending at the federal, state, and local levels of the U.S. government?

a. In 2009, total government spending equalled around $1 billion. b. Investment expenditure in the U.S. exceeds the total spending at all levels of government. c. Government spending at federal, state, and local levels declined steadily from the 1960s until about 1980. d. Through the 1950s and 1960s, the U.S. government maintained a balanced budget. e. Federal government spending exceeds state and local government spending in the U.S.

To allow the price mechanism to work, no one business firm should be large enough to have an _____________________.

Fill in the blank(s) with the appropriate word(s).

Recent research regarding increases in the Federal minimum wage shows that

A. unemployment is only slightly affected. B. the minimum wage has many benefits. C. it improves labor productivity. D. the unemployment rate rises.

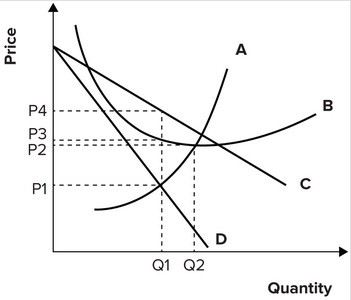

Refer to the graph shown depicting a monopolistically competitive firm. The demand curve is represented by curve:

A. A. B. B. C. C. D. D.