According to the Taylor rule, if inflation in the last year was 6% and output was 2% below its full-employment level, the nominal Fed funds rate should be

A) 3%.

B) 5%.

C) 7%.

D) 9%.

D

You might also like to view...

What was the intent behind the intervention of the Fed and Treasury in financial markets during the Financial Crisis of 2007-2009?

What will be an ideal response?

Regulation is guaranteed to be more efficient than a monopoly

A) True, the government is able to internalize the dead weight loss of the monopoly. B) True, the consumers are better off if government provides the product rather than a private firm. C) False, the government does not always have sufficient information to provide a more efficient market outcome. D) False, the consumers are worse off under government regulation.

Government intervention in the form of binding price floors or binding price ceilings will:

A) always enhance the efficiency of the market. B) result in either surpluses or shortages. C) move the market toward its equilibrium quantity more quickly. D) often be seen as necessary to decrease the activity of black markets.

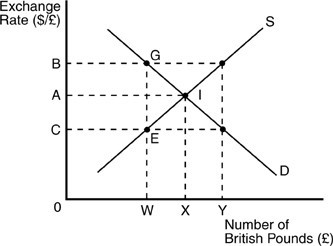

In the above figure, the equilibrium exchange rate between U.S. dollars and British pounds is

In the above figure, the equilibrium exchange rate between U.S. dollars and British pounds is

A. A. B. B. C. C. D. W.