On a consignment sale, the payment risk is

A. covered by the bank issuing the L/C.

B. covered by insurance.

C. assumed to be equally shared.

D. assumed by the buyer.

E. carried by the seller.

Answer: E

You might also like to view...

Use the following information to calculate cash paid for wages and salaries: Salaries expense$182,000?Salaries payable, January 1 7800?Salaries payable, December 31 13,400?

A. $176,400. B. $182,000. C. $189,800. D. $187,600. E. $168,600.

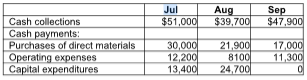

The cash balance on June 30 is projected to be $4500. The company has to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and has to pay interest every month at an annual rate of 4%. All financing transactions are assumed to take place at the end of the month. The loan balance should be repaid in increments of $5,000 whenever there is surplus cash. Calculate the amount of principal repayment at the

Burchfield, Inc. has prepared its third quarter budget and provided the following data:

A) $5,000

B) $10,000

C) $15,000

D) $20,000

List and explain the four alternative measures of capacity

An evaluation of the extent to which salespeople engage in cross-selling can be best measured through a _____ audit

a. disguised b. nondisguised c. companywide d. horizontal