The amount of income CT Corporation must report for this year is

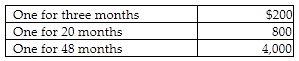

CT Computer Corporation, an accrual-basis taxpayer, sells service contracts on the computers it sells. At the beginning of January of this year, CT Corporation sold contracts with service to begin immediately:

A) $200.

B) $1,000.

C) $1,680.

D) $5,000.

C) $1,680.

Collections for services that do not extend beyond the next tax year may be accrued. $800 / 20 months = $40 per month. $40 × 12 months this year = $480 of the $800 accrued this year. $4,000/48 months = $83.33 per month × 12 months = $1,000. ($200 + $480 + $1,000 = $1,680) Note that the balance of the long-term contracts will be recognized in the following year as they cannot be deferred more than one tax year.

You might also like to view...

Zebra Company overstated its December 31, 2016 inventory by $5,200 . Which statement is true concerning Zebra's financial statement amounts for 2016?

a. The current ratio is overstated. b. Cost of goods sold is overstated. c. Working capital is understated. d. Net income is understated.

The World International Property Organization is an agency of the United Nations

Indicate whether the statement is true or false

________ are digital-only currencies.

A. E-checks B. Online payments C. Debit cards D. E-wallets E. Cryptocurrencies

Which of the following is an outcome of bureaucratic controls?

A) inflexible behavior B) decentralized decision making C) boundarylessness D) empowered workforce E) innovation and creativity