Using the information in situation 20-2, if government increases their spending by $50 and increases net taxes by 50, then equilibrium aggregate output will change by

A) -$100.

B) -$50.

C) $50.

D) $100.

C

You might also like to view...

When a market is in equilibrium

A) everyone has all they want of the commodity in question. B) there is no shortage and no surplus at the equilibrium price. C) the number of buyers is exactly equal to the number of sellers. D) the supply curve has the same slope as the demand curve.

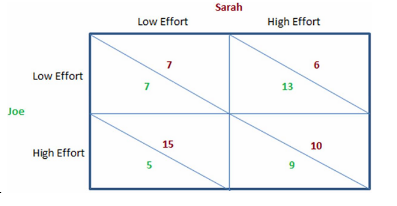

The game in the figure shown is a version of:

This figure shows the payoffs involved when Sarah and Joe work on a school project together for a single grade. They both will enjoy a higher grade when more effort is put into the project, but they also get pleasure from goofing off and not working on the project. The payoffs can be thought of as the utility each would get from the effort they individually put forth and the grade they jointly receive.

A. the prisoner's dilemma.

B. the first-mover advantage.

C. a sequential game.

D. a repeated game.

Suppose the government imposes a 20-cent tax on the sellers of iced tea. Which of the following is not correct? The tax would

A. discourage market activity. B. reduce the equilibrium quantity. C. raise the equilibrium price by 20 cents. D. shift the supply curve upward by 20 cents.

Viewed from the perspective of a U.S. corn farmer, gasoline price variability can be viewed as a source of

A. static variability. B. supply variability. C. demand and supply variability. D. demand variability.