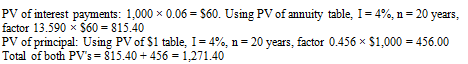

A 20-year bond pays 6% annually on a face value of $1,000. If similar bonds are currently yielding 4%, what is the market value of the bond? Use time value of money tables in Appendix B and Appendix D.

A) $1,271.40

B) $573.50

C) $770.80

D) Not enough information is given to tell.

A) $1,271.40

All else being equal, when the yield to maturity is less than the coupon/face rate, the bond will be priced above par:

Business

You might also like to view...

Explain briefly about the big new idea in marketing

What will be an ideal response?

Business

The forecasting section of a marketing plan includes predictions for both revenues and expenses

Indicate whether the statement is true or false

Business

When doing business internationally, managers from the United States should avoid long silences, which often signal discomfort

Indicate whether the statement is true or false

Business

The annualized NPV of Project B is ________. (See Table 11.11 )

A) $11,673 B) $12,947 C) $38,227 D) $21,828

Business