If Jim earns $300,000 this year and pays $75,000 in taxes and Sharon earns $80,000 this year and pays $20,000 in taxes, this tax system would appear to be

a. progressive

b. proportional.

c. regressive.

d. none of the above

b

You might also like to view...

A positive externality exists and government wants to impose a subsidy in order to bring about an efficient outcome. To accomplish its objective, government must set the subsidy equal to marginal

A. private cost. B. social benefit. C. external cost. D. social cost. E. external benefit.

The best example of an increase in capital is:

A) The discovery of new oil reserves. B) new computer software. C) legal immigration of computer programmers. D) conversion of military facilities to civilian uses.

How would imposing a minimum wage above the market-clearing wage affect employment in a competitive labor market?

A. Employment would increase as firms would illegally hire workers below the original competitive wage. B. Employment would increase as previously unemployed workers would be more encouraged to find a job. C. Employment would be unchanged as workers are nonresponsive to low wages. D. Employment would decrease as some workers who are willing to work at the lower competitive wage would no longer be able to find work. E. Employment would increase because a higher minimum wage would create more jobs for low-skilled workers.

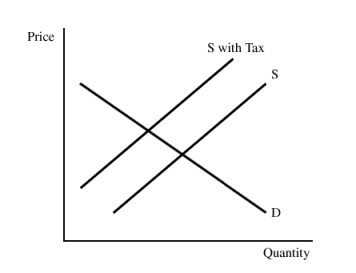

Figure 16.4The pollution tax in Figure 16.4:

Figure 16.4The pollution tax in Figure 16.4:

A. increases equilibrium output. B. internalizes the pollution externality. C. increases supply. D. All of these