If Olivia's income increases from $40,000 to $50,000 and her tax liability increases from $6,000 to $9,000, which of the following is true?

a. Her marginal tax rate is 18 percent in this range.

b. Her marginal tax rate is 30 percent in this range.

c. Her average tax rate was 22.5 percent when her income was $40,000.

d. The tax structure must be regressive in the range between $40,000 and $50,000.

B

You might also like to view...

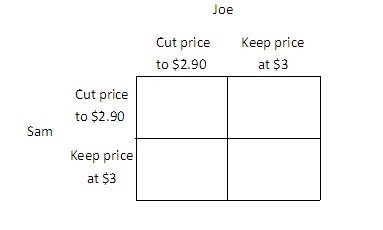

Joe is the owner of the 7-11 Mini Mart, Sam is the owner of the SuperAmerica Mini Mart, and together they are the only two gas stations in town. Currently, they both charge $3 per gallon, and each earns a profit of $1,000. If Joe cuts his price to $2.90 and Sam continues to charge $3, then Joe's profit will be $1,350, and Sam's profit will be $500. Similarly, if Sam cuts his price to $2.90 and Joe continues to charge $3, then Sam's profit will be $1,350, and Joe's profit will be $500. If Sam and Joe both cut their price to $2.90, then they will each earn a profit of $900. You may find it easier to answer the following questions if you fill in the payoff matrix below.

width="383" />If both players choose their dominated strategy they will each earn ________, and if both players choose their dominant strategy they will each earn ________. A. $900; $1000 B. $1000; $900 C. $500; $1350 D. $900; $1350

Today, people changed their expectations about the future. This change a. can cause a movement along a demand curve

b. can affect future demand but not today's demand. c. can affect today's demand. d. cannot affect either today's demand or future demand.

Which of the following measures market power?

A. Lerner index and Rothschild index. B. Rothschild index. C. Lerner index. D. Herfindahl-Hirschman index.

The present value of $1,000 to be received one year from now

A. is always $1,100. B. is always $1,000. C. is always $900. D. cannot be determined without knowing the interest rate.