The demand for an input will be more inelastic when

A) the demand for the product being produced is elastic.

B) the cost of the input is a relatively large percentage of total production costs.

C) the time period being considered is relatively long.

D) it is difficult to substitute other inputs for this input.

Answer: D

You might also like to view...

If a life insurance company offers coverage regardless of age, health status, or smoking history, it is likely to suffer

A) moral hazard problems. B) adverse selection problems. C) lower costs. D) low demand for its product.

Dynamic tax analysis is based on the recognition that as tax rates are increased

A) tax revenue collections will eventually decline. B) tax revenue collections will continually increase. C) tax revenue collections will change at the same rate as the tax rates. D) tax revenue collections will increase at a faster rate than the tax rate change.

Which of the following groups did Clinton target after his stimulus package failed in 1993?

a. High-income households b. Low-income households c. Foreign investors d. Only industrial workers e. Households with the lowest MPC

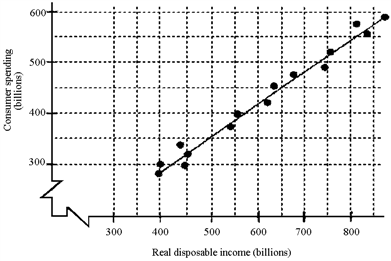

Figure 8-1

?

A. $100 billion B. $150 billion C. $250 billion D. $350 billion