A company needs to have $105,000 in 5 years, and will create a fund to insure that the $105,000 will be available. If it can earn a 6% return compounded annually, how much must the company invest in the fund today to equal the $105,000 at the end of 5 years?

A company needs to have $105,000 in 5 years, and will create a fund to insure that the $105,000 will be available. If it can earn a 6% return compounded annually, how much must the company invest in the fund today to equal the $105,000 at the end of 5 years?

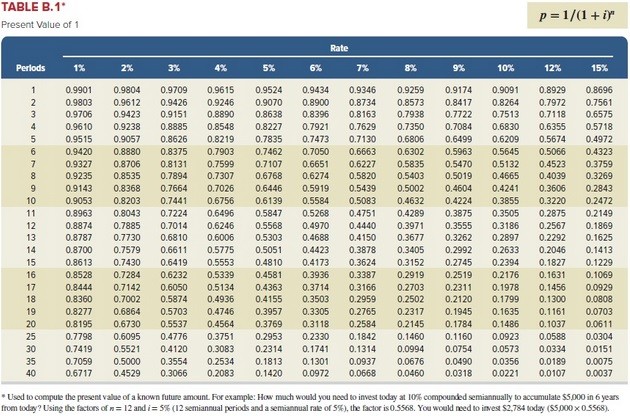

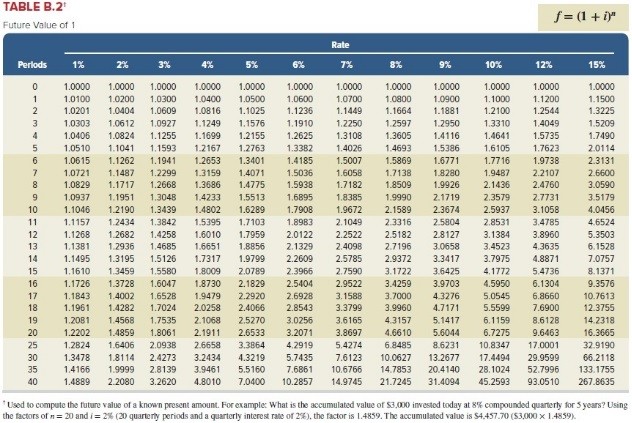

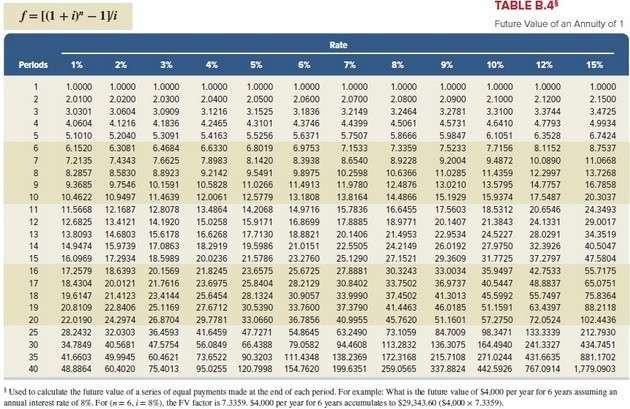

(PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

A. $78,467

B. $31,500

C. $98,700

D. $73,500

E. $140,506

Answer: A

You might also like to view...

Which employee likely has the most direct influence on the guest’s perception of service quality and value?

a. the general manager b. the frontline employee c. the back-of-house employee d. the owner

Two investments with exactly the same payback periods are not equally valuable to an investor because the timing of net cash flows may be different.

Answer the following statement true (T) or false (F)

Which of the following agreements were made as a part of the Basel III Accord (2010)??

A. ?Agreement to increase banks' capital (owners' equity) requirements in an effort to reduce the risk that mega bank failures will cause future financial crises B. ?Agreement to put restrictions on the ability of the U.S. government to use taxpayers' funds to bail out large financial institutions C. ?Agreement to create new organizations to help provide consumers clear and accurate information related to credit so that better-informed decisions can be made D. Agreement to permit the U.S. government to purchase up to $700 billion in troubled mortgages in an attempt to improve liquidity in the financial markets? E. ?Agreement to limit the salaries of executives whose companies received Troubled Asset Relief Program (TARP) funds.

Requiring a landowner to provide a public right-of-way across her land is: A)?A taking

B)?Not considered a taking because the owner would still have title to the land. C)?An easement by necessity. D)?None of the above