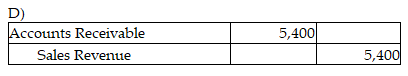

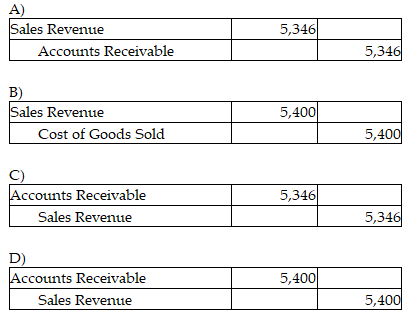

Forever Jewelers uses the gross method and a perpetual inventory system. On April 2, Forever sold merchandise with a cost of $1,400 for $5,400 to a customer on account with terms of 1/15, n/30. Which of the following journal entries correctly records the sales revenue?

You might also like to view...

Cascading goals being _____ and "cascade" to

A. short-term goals; long-term goals. B. with customers; employees. C. with the accounting/finance department; the shop floor. D. with customer-service representatives; upper-level management. E. at the top of the organization; individual employees.

A (n) _____ could help determine whether or not snacking consumers consider Kashi Tasty Little Crackers healthy and tasty in comparison to other brands..

A. predictive modeling B. perceptual map C. product positioning D. trend analysis E. internal marketing audit

Debra wanted to form a partnership with Lawrence. He agreed and they became co-owners in an equal partnership. This year, after expenses, the partnership had a profit of $200,000. How will the taxation of this profit be handled?

A. Since the partnership was Debra's idea, she will pay income tax on the profit on her personal tax return. B. The business will pay half of the tax liability, and Debra and Lawrence will pay the other half. C. Debra and Lawrence must both pay tax on the business's profit. D. The business itself will pay the taxes on the business's profit.

When would a sales price variance be listed as unfavorable?

A. When the actual sales price is equal to the standard sales price. B. When the actual sales volume is less than the budgeted sales volume. C. When the actual sales price is greater than the standard sales price. D. When the actual sales price is less than the standard sales price.